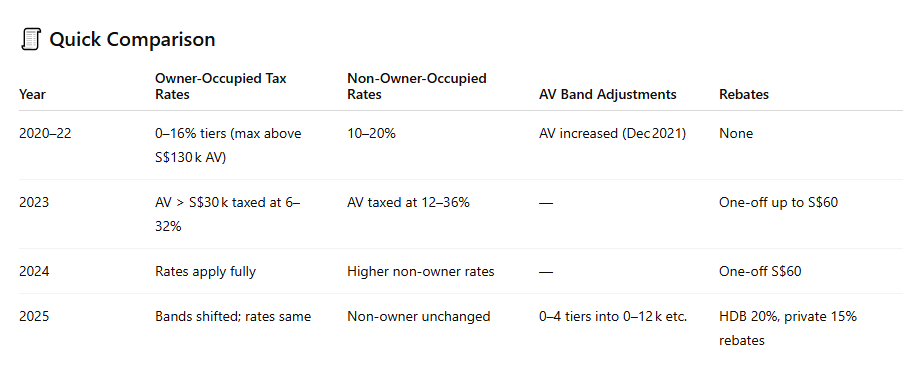

Recently had a few customers ask us this question, especially foreign owners who own investment properties here in Singapore. So, here’s a summary of the recent changes to Property Tax in Singapore.

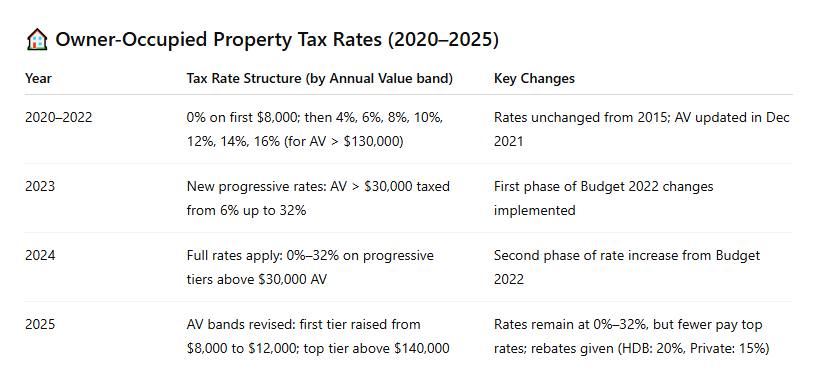

Timeline of Property Tax Changes

From 2020 to 2022

Rates unchanged: Owner‑occupied residential rates remained at the 2015–2022 structure:

0% on first S$8 k AV, then 4–16% tiers, capping at 16% above S$130 k AV (AV means Annual Value).

IRAS review of Annual Value (AV): In December 2021, IRAS revised HDB annual values upward from Jan 2022, leading to slight tax increases for most HDB flats – https://www.straitstimes.com/singapore/most-hdb-flat-owners-to-pay-more-in-property-taxes-next-year-iras

From 2023 to 2024

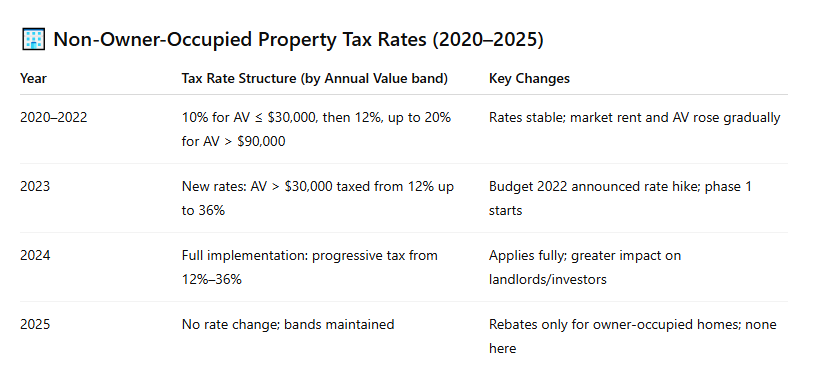

In the February 2022 Budget, a two-step rate hike was announced.

- Owner-occupied properties: Portions of AV above S$30 k taxed at 6–32% (raised from 4–16%)

- Non-owner-occupied properties: Rates increased to 12–36% by 2024 (up from 10–20%)

From 2025 onwards – AV band revisions effective 1 Jan 2025

- Owner-occupied bands adjusted—first tier raised from S$8 k to S$12 k, highest band increased from >S$100 k to >S$140 k

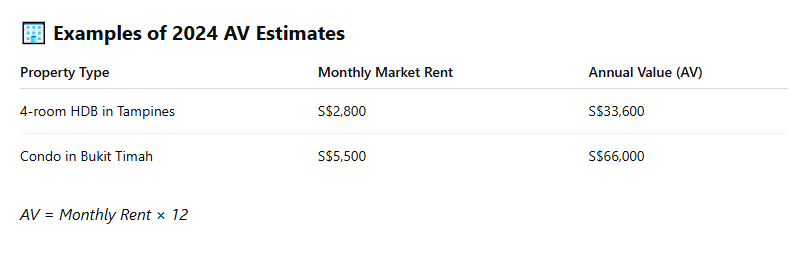

What Is Annual Value (AV)?

AV is the estimated annual rental income a property could fetch if it were rented out, excluding furnishings and maintenance costs, as determined by IRAS.

How AV Is Determined?

IRAS uses a mass appraisal method based on

Market Rental Data:

- IRAS studies recent rental transactions of comparable properties in the same area.

- For example, for a 4-room HDB flat in Ang Mo Kio, IRAS compares recent rentals of similar units in that estate.

Property Characteristics:

- Type (HDB, condo, landed)

- Size (floor area)

- Location and floor level (for flats)

- Age and condition of the property

- Amenities nearby (MRT, schools, malls)

Assumption of Unfurnished Rental:

- AV is calculated as if the property is unfurnished, regardless of how it’s actually rented.

Gross Annual Rent:

- This does not account for expenses like maintenance, property tax, or agent fees.